All About Tax Accountant In Vancouver, Bc

Wiki Article

What Does Virtual Cfo In Vancouver Mean?

Table of Contents3 Easy Facts About Tax Consultant Vancouver ShownThe Best Guide To Virtual Cfo In VancouverTax Accountant In Vancouver, Bc Fundamentals ExplainedFascination About Cfo Company VancouverThe Only Guide to Vancouver Accounting FirmSmall Business Accountant Vancouver Things To Know Before You Get This

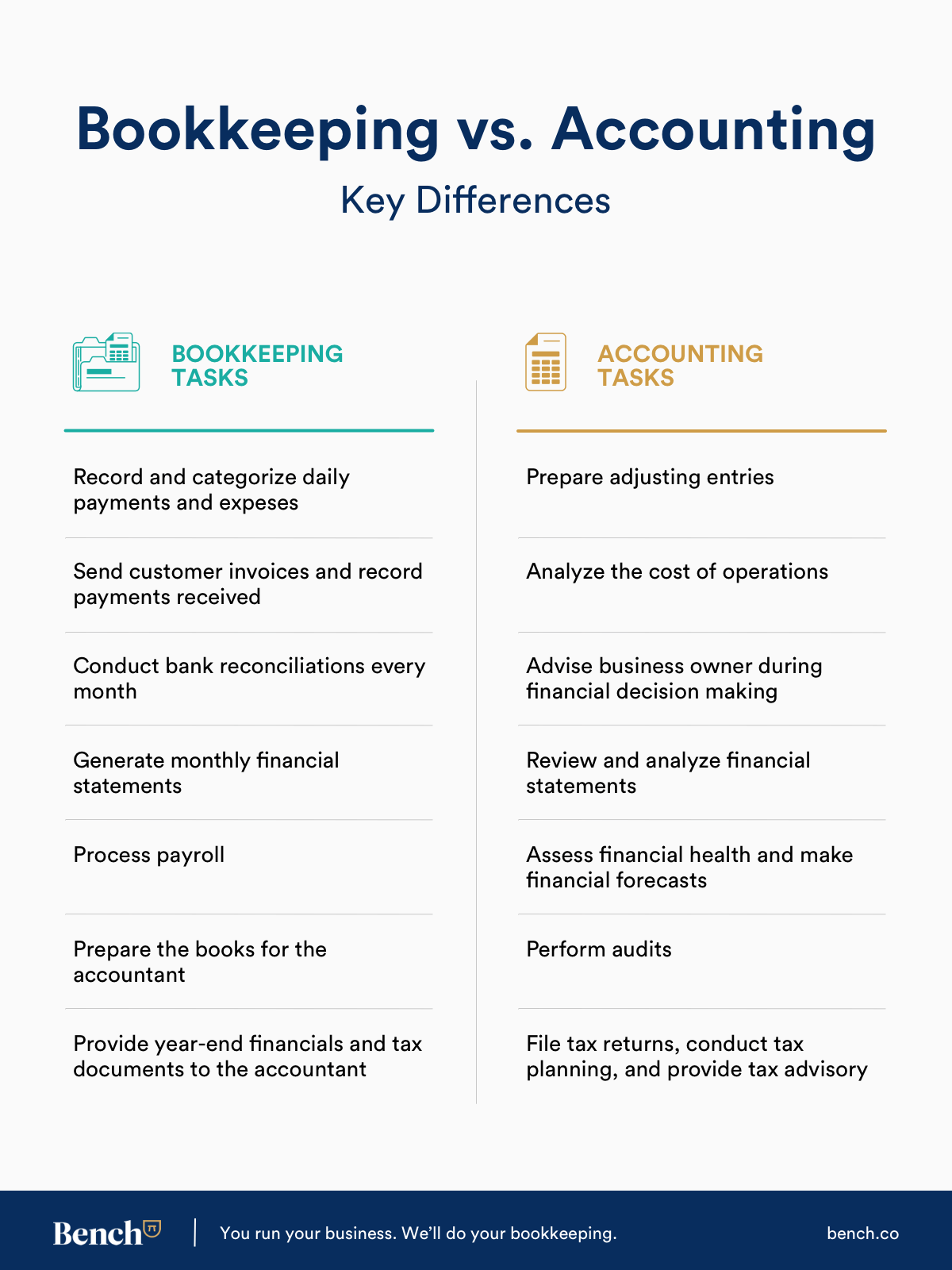

Here are some advantages to employing an accounting professional over an accountant: An accountant can provide you a detailed view of your company's financial state, in addition to techniques and also referrals for making monetary choices. Bookkeepers are just accountable for taping monetary purchases. Accountants are called for to complete more schooling, accreditations and job experience than bookkeepers.

It can be hard to assess the ideal time to hire a bookkeeping expert or bookkeeper or to identify if you require one in all. While many small companies work with an accountant as a specialist, you have a number of alternatives for managing financial tasks. For instance, some local business owners do their own accounting on software their accountant recommends or utilizes, offering it to the accountant on a regular, month-to-month or quarterly basis for action.

It might take some history study to find an appropriate bookkeeper due to the fact that, unlike accounting professionals, they are not required to hold an expert certification. A strong recommendation from a trusted associate or years of experience are important aspects when employing an accountant.

See This Report on Tax Accountant In Vancouver, Bc

For tiny services, adept money management is an important aspect of survival and growth, so it's a good idea to work with a financial expert from the beginning. If you like to go it alone, think about starting with accountancy software application as well as keeping your books diligently approximately day. In this way, need to you require to hire a specialist down the line, they will have exposure into the full monetary background of your service.

Some source interviews were performed for a previous variation of this article.

The 5-Second Trick For Cfo Company Vancouver

When it comes to the ins and outs of tax obligations, bookkeeping as well as money, nonetheless, it never ever harms to have a seasoned specialist to turn to for assistance. A growing number of accounting professionals are also caring for things such as money circulation estimates, invoicing as well as HR. Eventually, a lot of them are handling CFO-like duties.Local business owners can expect their accounting professionals to assist with: Selecting the business structure that's right for you is essential. It influences just how much you pay in taxes, the documentation you need to file and your personal liability. If you're aiming to transform to a different company framework, it could result in tax obligation repercussions as well as various other problems.

Also firms that are the exact same size and also market pay extremely various amounts for bookkeeping. These expenses do not transform into cash, they are necessary for running your company.

What Does Tax Accountant In Vancouver, Bc Mean?

The typical cost of audit solutions for little service varies for each unique circumstance. The average monthly accounting charges for a little company will increase as you add more solutions as well as the jobs obtain harder.For instance, you can videotape purchases and also procedure pay-roll using online software. You enter amounts into the software application, and also the program calculates total amounts for you. Sometimes, payroll software program for accounting professionals permits your accountant to provide payroll handling for you at really little added cost. Software solutions come in all shapes and sizes.

Fascination About Outsourced Cfo Services

If you're a new business proprietor, don't forget to element accounting expenses right into your budget. Management prices and accountant costs aren't the only audit expenses.Your ability to lead employees, serve clients, BC and also make choices can suffer. Your time is likewise beneficial and also should be considered when checking out accountancy prices. The moment spent on accountancy jobs does not produce revenue. The much less time you spend on bookkeeping as well as tax obligations, the even more time you have to expand your business.

This is not intended as legal suggestions; to find out more, please visit this site..

Getting My Small Business Accountant Vancouver To Work

Report this wiki page